Tax Alert - Property developers should be aware of upcoming changes to Victorian state taxes

Property developers should be aware of upcoming changes to Victorian state taxes

During the 2023 calendar year, the Victorian Parliament passed some significant changes to various state taxes, including land tax, stamp duty and the Windfall Gains Tax.

The key detail to note is that not all of these changes have the same starting dates, so we will consider the changes in order, on a timeline basis.

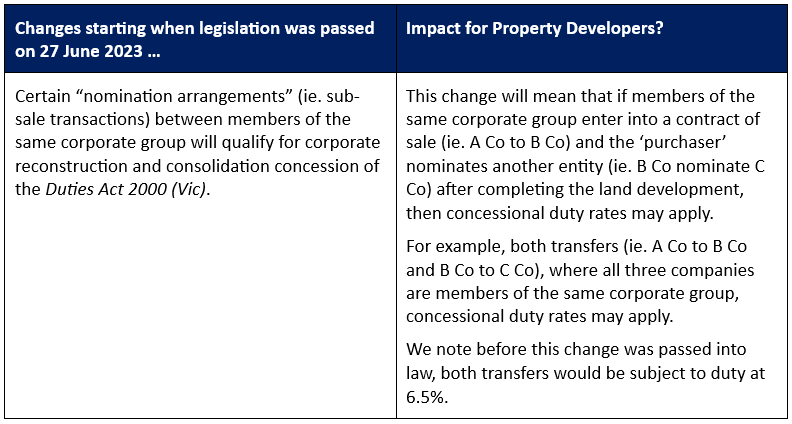

Changes starting when legislation was passed on 27 June 2023

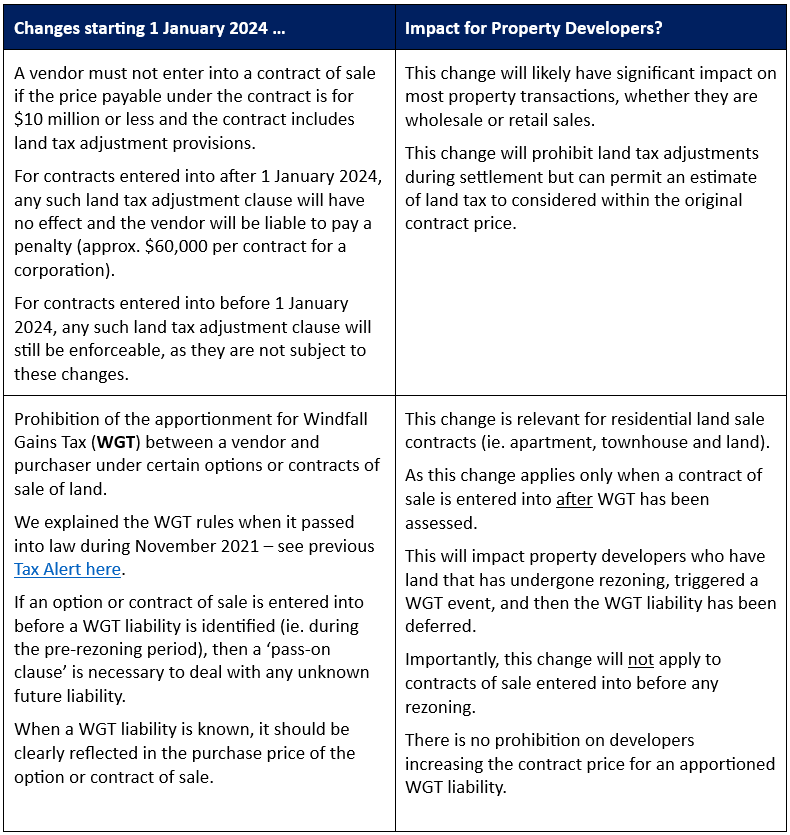

Changes starting 1 January 2024

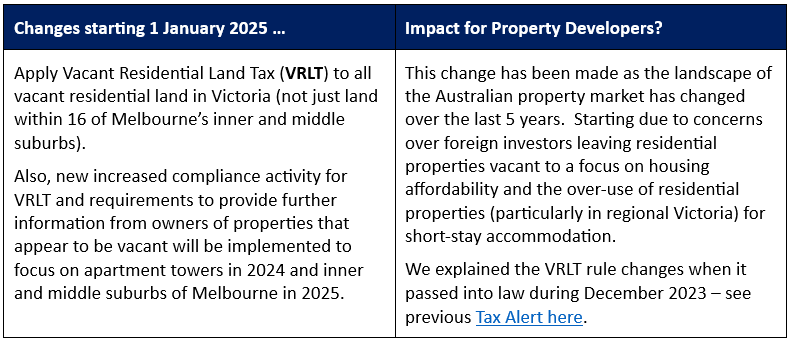

Changes starting 1 January 2025

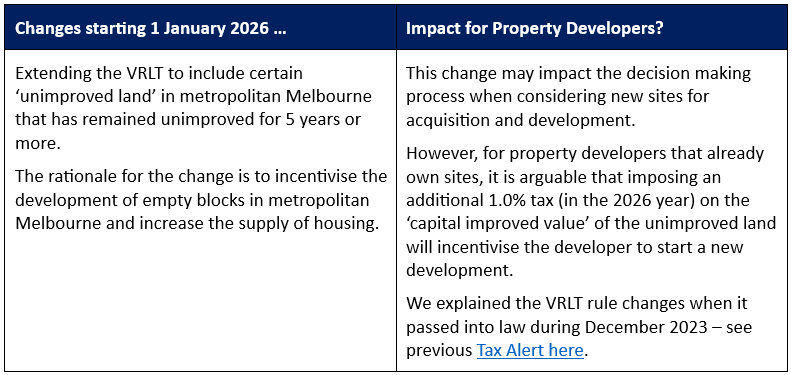

Changes starting 1 January 2026

Please do not hesitate to contact your Lowe Lippmann Relationship Partner if you wish to discuss any of these matters further.

Liability limited by a scheme approved under Professional Standards Legislation