2024

2024

Let us keep you informed

Learn more about tax areas and issues that may impact you.

22 Apr, 2024

Planning for Superannuation Contributions before 30 June 2024 As the end of the financial year is approaching, we take this opportunity to remind you of the superannuation obligations for each of the following three groups: Self-employed & other taxpayers; Employers with only related-party employees; and Employers with unrelated employees. Each group will be considered below under three separate headings and we recommend you consider the group most relevant to your circumstances.

15 Apr, 2024

Commercial and Industrial Property Tax Reform The Victorian Government announced in the 2023-24 State Budget it will be progressively abolishing stamp duty on commercial and industrial property and replacing it with an annual tax, based on unimproved land value, called the Commercial and Industrial Property Tax ( the CIP Tax ). The CIP Tax regime will apply to commercial and industrial property transactions with both a contract and settlement date on or after 1 July 2024 .

08 Apr, 2024

During September 2023, the Treasury Laws Amendment (Support for Small Business and Charities and Other Measures) Bill 2023 ( the Bill ) was introduced to Parliament and has been thoroughly debated for the last six months. Last week, the Bill passed the Senate with some minor amendments proposed which need to be ratified by the House of Representatives before the Bill receives Royal assent. This Bill contains various small business tax measures, which include: A temporarily increase the instant asset write-off threshold for small and medium businesses from $1,000 to $30,000; Providing small and medium businesses with a bonus 20% deduction of the cost of eligible assets or improvements to existing assets that support electrification or more efficient energy use; and Limiting the amount of non-arm’s length income that arises relating to a general non-arm’s length expense and to narrow the application of these rules. We will discuss each of these small business tax measures in detail below.

19 Mar, 2024

2024 FBT Year End is Fast Approaching! The end of the Fringe Benefits Tax (FBT) year is fast approaching on 31 March 2024, so we take this opportunity to revisit some hot FBT topics for both employers and employees, including: FBT exemption for electric cars Work from home arrangements Contractor or employee Mismatched information for entertainment claimed as a deduction and what is reported for FBT purposes Employee contributions by journal entry Not lodging FBT returns Housekeeping essentials

23 Feb, 2024

Superannuation contribution caps to increase from 1 July 2024 The Federal Government has announced some key changes to the superannuation system that will take effect from 1 July 2024 . Key changes include an increase in the concessional and non-concessional contribution caps, the bring forward caps, and the total superannuation balance thresholds that apply to determine the maximum amount of bring forward non-concessional contributions available to members.

25 Jan, 2024

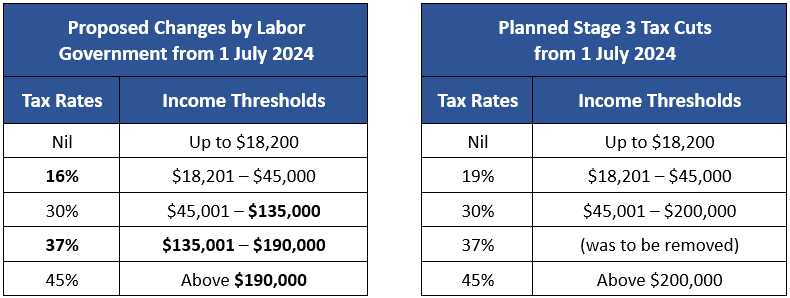

Government announces changes to planned Stage 3 tax cuts The Federal Government has now announced changes to the marginal tax rates (and income thresholds, or brackets) starting from 1 July 2024. The announcement is a move away from the planned “Stage 3 tax cuts”. What were the planned Stage 3 tax cuts? The previous Coalition Government announced a long-term plan to implement three stages of reduced marginal tax rates and brackets between the 2018-19 and 2024-25 income years, with the final Stage 3 tax cuts due to start from 1 July 2024. The current Labor Government agreed in the last election to keep these changes. What are the announced changes? The changes to the Stage 3 tax cuts will now provide lower to middle income earners with greater tax relief and effectively halve the tax cuts for higher income earners.

14 Jan, 2024

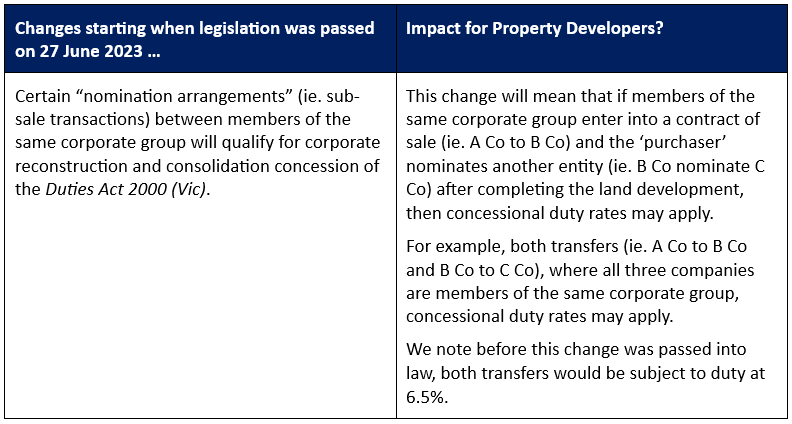

Property developers should be aware of upcoming changes to Victorian state taxes During the 2023 calendar year, the Victorian Parliament passed some significant changes to various state taxes, including land tax, duty and the Windfall Gains Tax. The key detail to note is that not all of these changes have the same starting dates, so we will consider the changes in order, on a timeline basis.

Privacy Policy | Disclaimer | Site Map

Liability limited by a scheme approved under Professional Standards Legislation

Copyright Lowe Lippmann Pty Ltd ©

| Websites for accountants by Wolters Kluwer